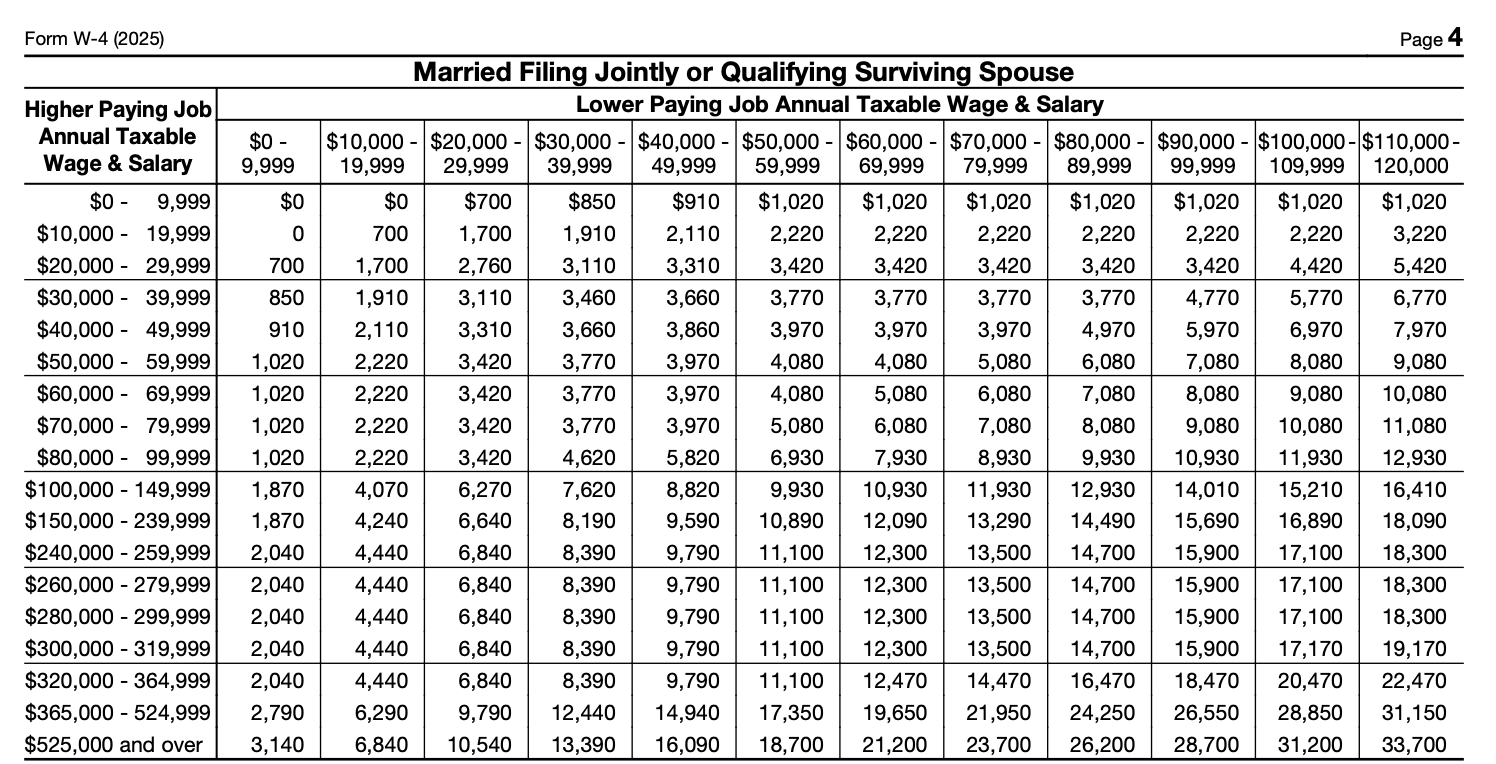

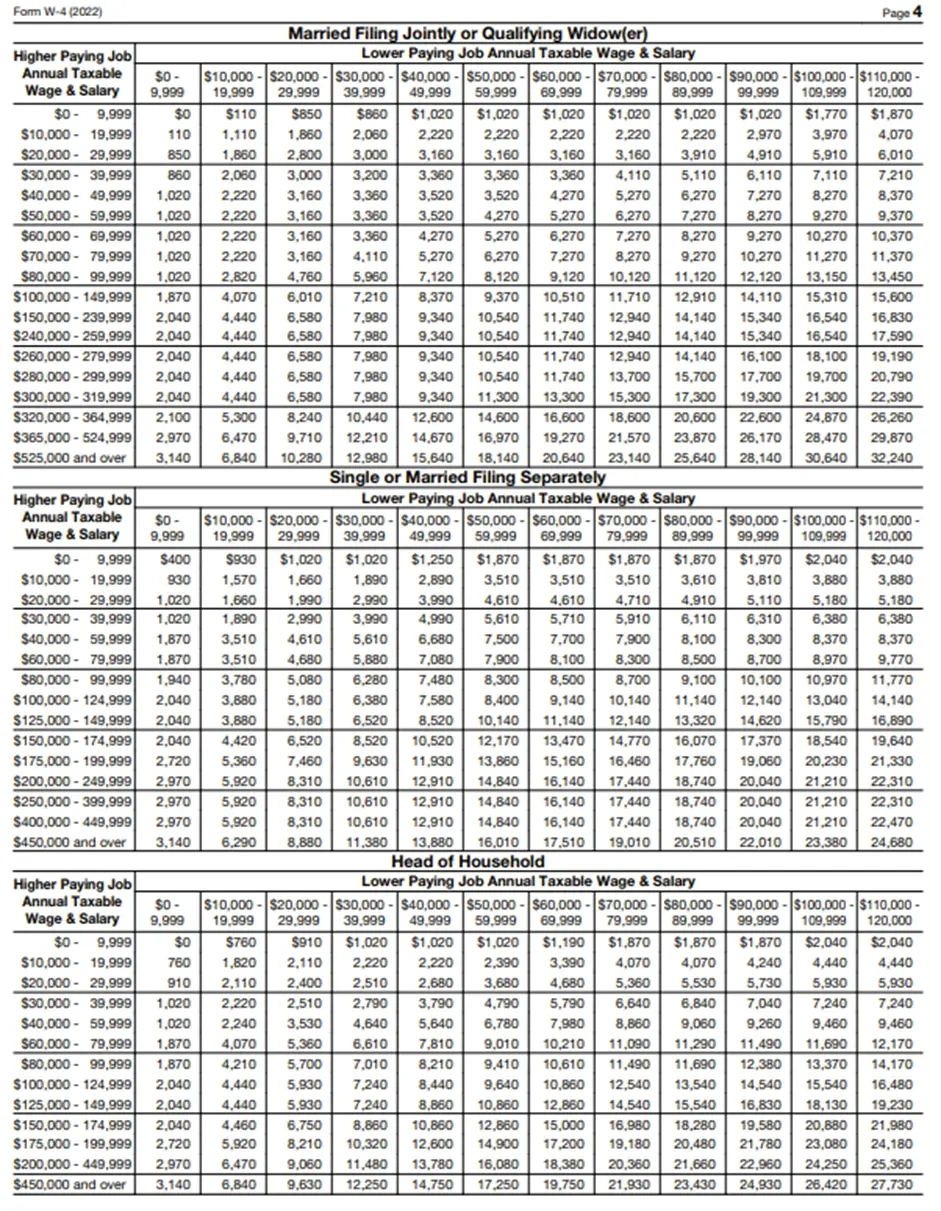

Multiplication Worksheets | W4 Multiple Jobs Worksheet – Are you juggling multiple jobs to make ends meet? Balancing different schedules and responsibilities can be challenging, but with the right tools, you can stay on top of your finances and make sure you’re not hit with any surprises come tax season. One important tool to help you manage your taxes when you have multiple jobs is the W4 Multiple Jobs Worksheet. This handy worksheet allows you to calculate the correct amount of tax to withhold from each paycheck, ensuring that you don’t end up owing a large sum to the IRS later on.

Mastering the Art of Juggling Jobs

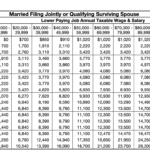

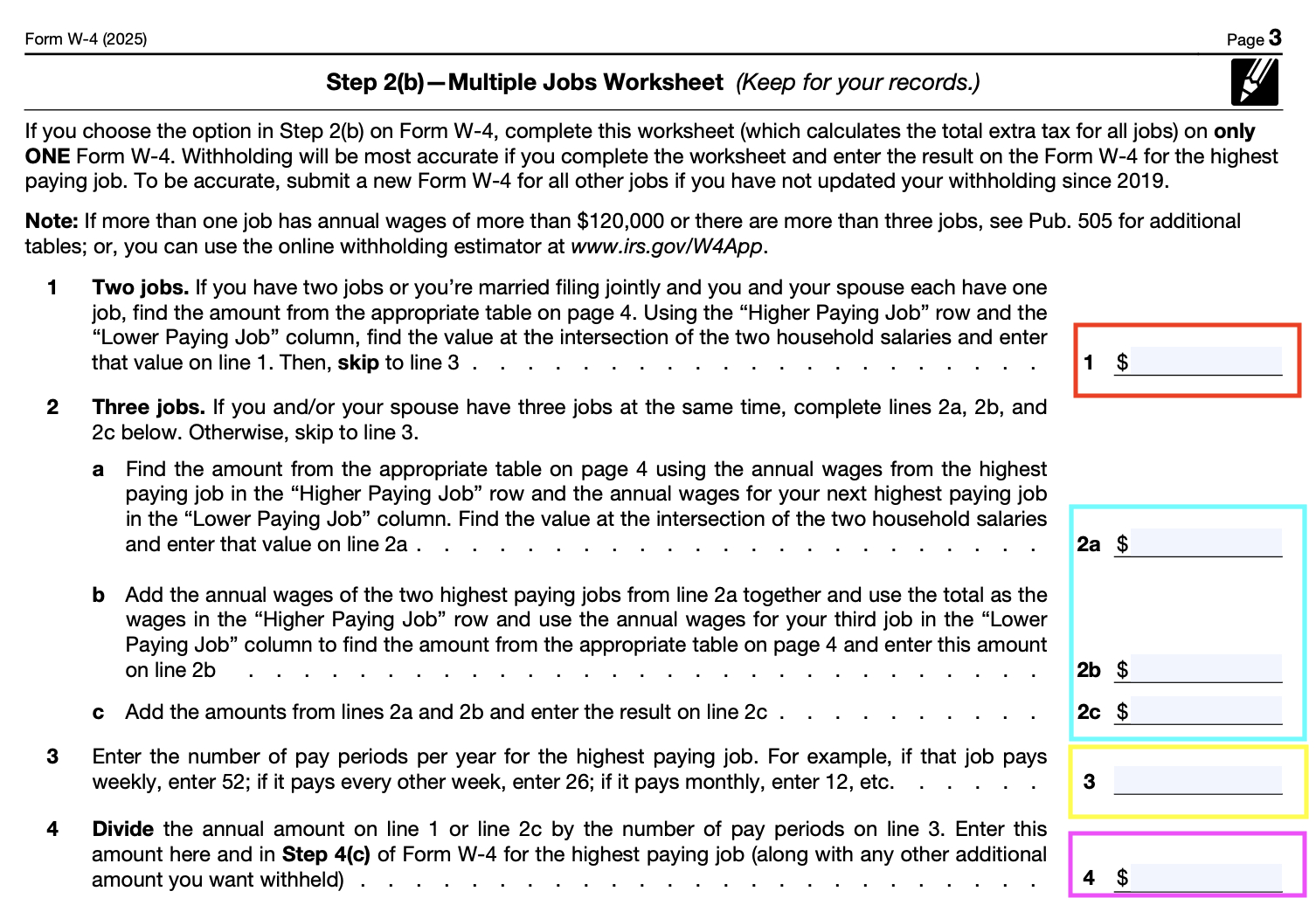

When you have multiple jobs, it’s crucial to make sure you’re withholding the right amount of taxes from each paycheck. If you don’t, you could end up owing money to the IRS at the end of the year, or even facing penalties for underpayment. The W4 Multiple Jobs Worksheet helps you determine the correct amount of tax to withhold based on your total income and the number of jobs you have. By using this worksheet, you can avoid any unpleasant surprises and keep your finances in check.

Managing multiple jobs can be stressful, but staying financially savvy doesn’t have to be. With the W4 Multiple Jobs Worksheet, you can take control of your tax situation and ensure that you’re not caught off guard by unexpected tax bills. By mastering the art of juggling jobs and keeping your finances in order, you can focus on what’s important – your work and your well-being. So don’t let the stress of multiple jobs get you down – with the right tools and a positive attitude, you can stay on top of your finances and thrive in your busy schedule.

Stay Financially Savvy with the W4 Multiple Jobs Worksheet

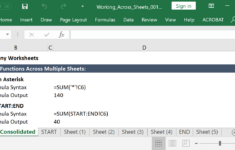

The W4 Multiple Jobs Worksheet is a valuable resource for anyone juggling multiple jobs. By using this worksheet, you can calculate the correct amount of tax to withhold from each paycheck, ensuring that you’re not hit with any surprises at tax time. Whether you’re a freelancer, a part-time worker, or a full-time employee with multiple jobs, this worksheet can help you stay financially savvy and in control of your tax situation.

One of the key benefits of the W4 Multiple Jobs Worksheet is that it allows you to account for all of your sources of income and adjust your withholding accordingly. This means that you can avoid underpaying or overpaying on your taxes, and make sure that you’re not left scrambling to come up with a large tax payment at the end of the year. By using this worksheet, you can take the guesswork out of tax withholding and ensure that your finances are in order, no matter how many jobs you have.

Juggling multiple jobs can be challenging, but with the right tools and resources, you can keep your finances in check and avoid any tax-related surprises. The W4 Multiple Jobs Worksheet is a valuable tool for anyone with multiple sources of income, helping you calculate the correct amount of tax to withhold and ensuring that you’re not caught off guard by unexpected tax bills. So if you’re feeling overwhelmed by your busy schedule, take a deep breath and remember that with the W4 Multiple Jobs Worksheet, you can stay financially savvy and in control of your taxes.

W4 Multiple Jobs Worksheet

Multiplication Worksheets…

Copyright Disclaimer: The rights to all images displayed belong to their original owners. Contact us for attribution or removal if necessary.